I believe enough pieces of the puzzle are coming together to allow truly modern banking to incubate and develop, especially within the UK.

For the purposes of discussion below, ‘banking’ refers to retail banking only. Commercial and Investment banks have their own sets of problems.

The Shift

With the introduction of the iPhone in 2007 the dynamic between customers, carriers and manufacturers shifted drastically. Prior to this carriers dominated the value chain, often demanding exclusivity or branding on phones and their own software pre-installed, but ultimately they offered an undifferentiated service. They tied customers into long-term contracts with ‘good enough’ devices and customers continued to renew every two years (or sometimes longer) because their carrier was ‘just fine’.

But with the launch of the iPhone and Apple’s partnership with AT&T in the US (and O2 in the UK), the power shifted. Apple refused to install software for AT&T or allow exclusive branding; conversely AT&T committed to significant marketing spend and guaranteed unit sales. Customers finally had a reason to switch carriers and many endured the hassle of this simply to experience the step-change in mobile computing. It took four years for Verizon to follow AT&T’s lead, only after losing a significant number of customers, and the leverage the carriers once had now sat with Apple. Customers cared more about their iPhone than they did about their mobile provider and this situation repeated itself across the world. Many carriers saw Android as a potential defense but it was too late; the power had changed hands.

The fundamental shift of carriers from dominant decision-makers to ‘dumb pipes’ can be attributed to the leap in technology coupled with the vastly superior user experience of iPhone OS. As design and development trends towards delivering products that are ‘good enough’ only substantial changes like this will reshape the dynamics of a market.

The reason to highlight all of this is because I believe the same shift is happening in banking and, as with the carriers, the banks are not well prepared. The parallels are uncanny and the shift has already begun. Banks control the majority of the terms and conditions of the relationship with the customer but offer completely standard services across the board. The ‘good enough’ service provided by banks means customers are unlikely to switch unless they have a compelling reason.

The difference this time is that banks have more to worry about than just Apple. Their products are being attacked from all sides and the underlying purpose and structure of banking is being questioned. It won’t be long until the ‘AT&T of banking’ submits to the pressures and the full scale change of the industry can begin.

The Infrastructure

The fundamental purpose of a bank is to provide a safe store of wealth for savers and a predictable source of loans for borrowers. But what happens when wealth is simply another bit stored on a server. You could argue it already is but by accelerating this transfer from physical to digital, money can become truly liquid.

As the cost of computing continues to trend towards zero the connectivity of the world is exploding. A 50 person company handles more messages per day than the global SMS network, music streaming is seeing significant year-on-year growth and streaming services are consistently stealing attention from cable TV. The success of all of these services is linked to one technology: cloud computing (and more often than not AWS). By effectively leveraging cloud computing, these companies have kept costs low while reaching enormous scale for each of their products.

The way in which this could apply to banking is almost exactly the same. Start-ups will flourish based on specific banking needs, using cloud computing to achieve scale and remaining small enough to iterate and adapt to customer needs. This trend has already started but there remains a key component which could accelerate this: an ‘AWS for Banking’.

Since their inception, banks have had a direct relationship with their customers. They needed to. They held the physical cash, provided the security for said cash and customers withdrew when necessary. As the relationship developed customers required additional services, such as credit cards or the ability to invest. Over time this resulted in a complex relationship with no real transparency and a general distaste towards interacting with banks.

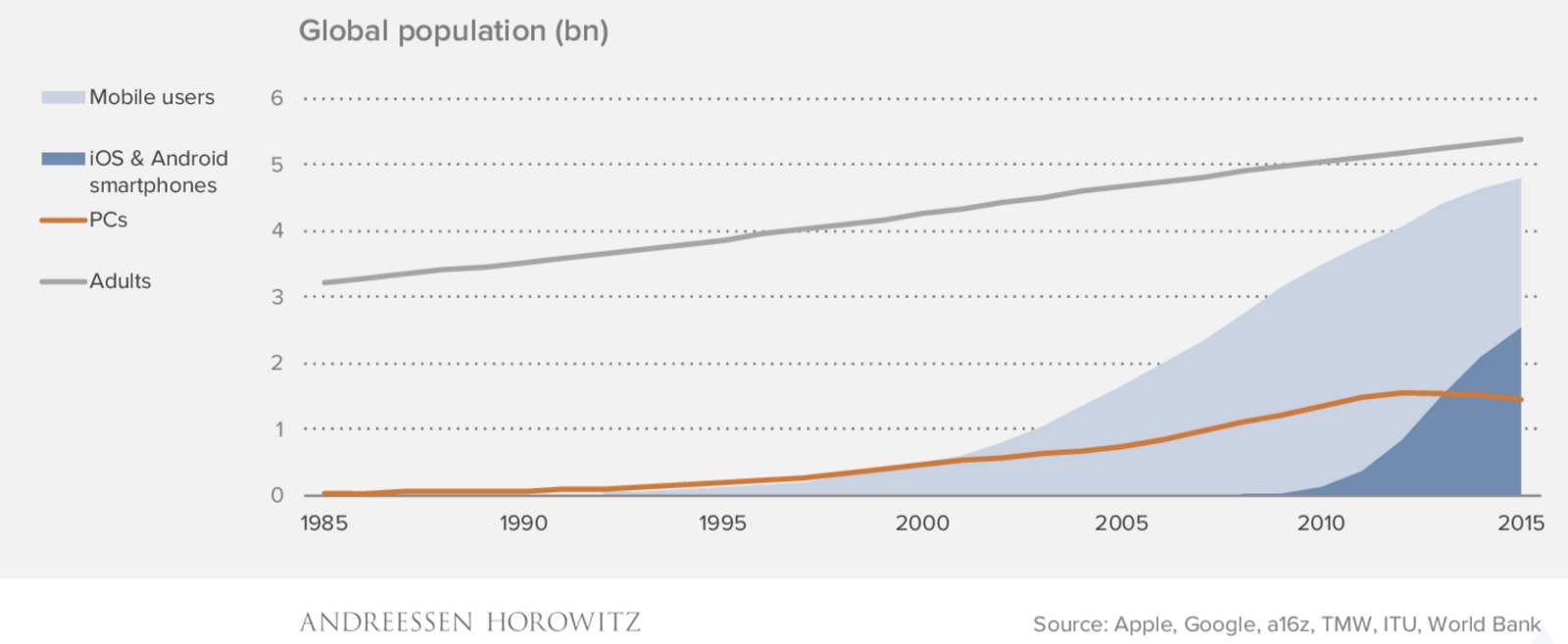

Then came smartphones and they had an adoption rate unlike anything before. Customers began to shop, communicate and entertain themselves through their devices; technology companies and their products captured a huge amount of attention and became the primary interface between consumers and services. Meanwhile, banking services were laggards, providing limited functionality to smartphone users with many only offering the ability to view account balances. This left the device manufacturers as gatekeepers of customer attention and, as expected, they are now beginning to develop the smartphone into a personal hub to manage and control all of life’s complexity, and banking is a key part of this.

While it may be a dramatic shift for banks to relinquish the relationship with the customer, attitudes of millennials suggest that this may not be far off. 71% of millennials have gone as far to say they would rather visit the dentist than interact with their bank and this is a trend I believe will permeate further.

Innovative start-ups, such as TransferWise and Monzo, understand this and are already providing customers with valuable services delivered through frictionless experiences. However, to remain agile and scale effectively they require increasing access to reliable and secure infrastructure fine-tuned for banking. They need an ‘AWS for Banking’.

And the answer to who is the AWS for banking may in fact be the most obvious name: Amazon. Tesco Bank already uses AWS for a hybrid-approach and Amazon is courting a variety of large banks in the US.

The regulatory gap between the banking start-ups and AWS remains uncertain, and perhaps represents an opportunity, but the shift is coming. First slowly and then very suddenly. Innovative companies like solarisBank and Bankable may just accelerate it further.

The Unbundling

It’s becoming apparent that the concept of banking is changing. Part of that is driven by technology and part by the change in mind-set of younger generations.

The expectation of what a bank does is almost being split in half and the two functions that remain can be broadly defined as: Dumb Pipe and Advisor.

As the split occurs, banks may need to decide which side of the divide they wish to exist on. But key differences could drive the success of those on each side.

For those on the advisor side there will be an increasing demand for a personal and proactive experience. Current banks, even after many decades of capturing our transaction history, provide little-to-no personalisation and only now are we beginning to see aggregated dashboards of our balances.

Beyond this basic functionality lies a myriad of potential services. My theory is that customers approach banking from the context of a buying decision - Can I afford X? - but the traditional model of current accounts offers a historic view of financial transactions and doesn’t support a customer’s future goals. To earmark money for specific purpose requires the customer to either keep a mental note or create separate savings accounts for each goal (some are slowly adopting buckets for savings). By failing to work with customers to achieve their goals, banks are reducing their status to simple storage providers.

More recently, start-ups are beginning to use early stages of the Open Banking Standard and PSD2 to introduce a layer on top of the conventional banking experience. This includes analysing and predicting transactions to provide basic insights but also automating balance alerts and savings advice. Currently banks offer no personalised analysis and monthly (paper) statements are the norm.

An area that has yet to be fully explored is the provision of credit to customers. Banks regularly ask for information they already have documented to allow customers to submit a request for a loan or credit card. While there have been issues in the UK around predatory lending practices, real-time interventions such appropriate just-in-time recommendations and real-time credit checks based on previous customer data would allow for proactive ‘available credit’ allowances to be offered to customers, reacting appropriately to changes as and when they occur. But this can only be achieved by modernising the banking infrastructure to allow for reactive and contextual computing. It’s still commonplace within banking for payments to require more than a day to clear and even then, they may still require manual interventions. The current processes and technology are not capable of meeting modern consumer expectations.

As new technologies and platforms become mainstream, consumers increasingly expect the products and services they use daily to adapt. However banks are typically not early adopters. Experimentation and iteration of digital products should not threaten the ability for a bank to protect and secure assets, however it took over 6 months for the first bank in the UK to incorporate Touch ID and quickly afterwards it was found that their implementation couldn’t survive basic penetration testing.

Similarly, Apple Pay’s introduction in the UK only had a subset of the largest banks. For some of the holdouts, there were clearly strategic reasons to forgo the technology, but customers were vocal about their desire to use Apple Pay and many considered switching banks completely. In fact, there were even cases where customers publicly announced their defection.

Banks display a complete lack of empathy for customers and an understanding of their motivations; meanwhile start-ups are filling the gaps and slowly unbundling banks.

Which UK banks cross-check card transactions with phone location? None that I can find. A start-up perhaps? Monzo, with only 60 staff, offers this.

Which UK banks are experimenting with bots (both on Facebook or Alexa)? Again, I struggle to find any activity here. Start-ups? Cleo, Plum and others.

Transparent and/or fee free foreign transactions? Typically only if you have a Premium account. Finally, start-ups doing this? TransferWise, Revolut and Monzo are a selection of the options available.

What sets apart the start-ups in my opinion, and it’s a similar theme across all recent technology companies, is their ability to adopt and adapt to changes in platforms and consumer behaviour, often experimenting before consumers are even aware of the changes. They are persistent and present across devices and platforms.

Banks can’t compete with 50 user experience specialists in a start-up, but start-ups can’t compete with the global infrastructure of a bank. The two need each other and the relationship can be entirely win-win but the core proposition of a bank must change first.

For customers the underlying technology doesn’t matter, the product does. How we interact with banks on a daily basis and the ramifications of such a shift are up for debate but I believe opportunities exist at all sections of the value chain, for incumbents and start-ups alike. Some of the incumbents may just find the pill difficult to swallow.

The Fight

With consumer distaste towards banks, the impact of regulation like PSD2 and the hunger of start-ups looking to establish themselves within the banking industry we may soon see a re-balancing of the banking value chain. As with the smartphone market, consumers will drive this change and I believe the banks will struggle to match the superior user experience offered by a modern ‘bank’. Unencumbered by legacy IT and built from the ground up by engineers with vastly different assumptions, start-ups will almost certainly offer something that is designed for modern consumers, and will ultimately live or die based on this.

What hasn’t been discussed here, and may in fact have a greater long-term impact, is the potential for the current crop of dominant technology companies to provide bank-like services directly to their customers. Facebook is laying the groundwork for payments functionality, at the very least; Apple is abstracting away banks with Apple Pay and unlocking entirely new ways of storing value; and, Amazon has previously experimented with lending. But for me, the real opportunity present here is for start-ups to take on banks - David vs. Goliath.