Saving early and often with four great iOS apps.

Disclaimer: This content is for informational purposes only and should not be taken tax, investment, financial, or other advice.

I consider myself financially literate - in the last few years I’ve successfully purchased my first house, married in DisneyWorld, and grown my savings / investments throughout.

My general principles for personal finances are:

- Every penny has a purpose - save first, know your committed monthly spend, and track disposable monthly spend

- Don’t rely on yourself to save - automate it as much as possible

- Build a 6 month living expenses buffer, that’s accessible for sudden expenses and has no risk exposure (and therefore likely no / marginal returns)

- Clear debt as soon as possible, working from highest APR downwards

- Pay into your pension as much as reasonably possible, as early as possible, taking advantage of employer matching

- Pick a pension fund with a sensible target retirement date (to skew it towards stocks in early years) and with low management fees (under 0.5% annually)

Below I explore the key apps and services I use, focused on Principles 1, 2, and 3.

Principle 4 is highly contextual based on the debts you might’ve accrued over time (student loan, car payments, credit card, etc.); start by getting your arms around it all and work from there.

Principles 5 and 6 usually take a bit more effort - get into your pension’s online account and take the time to view their projections; you’ll want to be more focused on stock investing in your early years and rebalance this to bonds over time. Many pension funds now take this approach automatically, based on your selected retirement date.

TL;DR:

- You can greatly improve your personal financial management using Monzo and Plum.

- Nude will help you work towards your first home and Freetrade will introduce you to stock investing.

Monzo

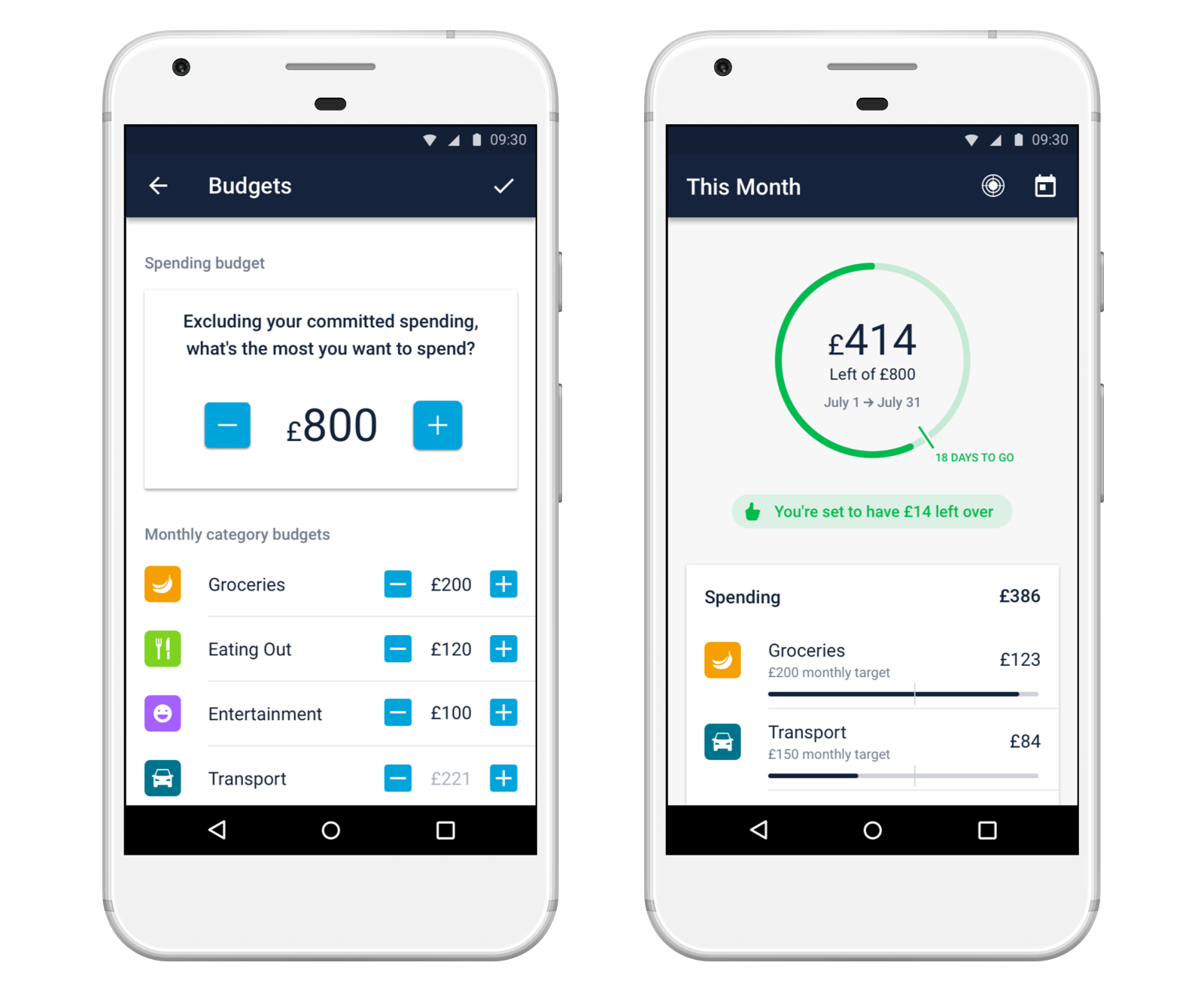

The digital bank has three tiers (free, £5 pm, £15 pm) but the free tier is all you need to achieve Principles 1 and 3.

Firstly, their spend categorisation is mostly automatic and allows you to optionally tag transactions as recurring spend. Monzo takes this plus your direct debits and standing orders to give you a monthly view of committed spend, estimated transaction dates, and remaining balance.

Secondly, Monzo’s Round Ups feature will automatically save up to 99p per transaction in a separate Savings Pot. Additional Pots can be created for your 6 month buffer and specific short-term goals (e.g. holidays, Christmas shopping); automatic monthly deposits can also be set up to work towards your goal.

And that’s not even mentioning Monzo’s other benefits such as spend notifications, fee free foreign transactions, shared tabs, and more.

Switching bank accounts can seem incredibly daunting. The Current Account Switching Service is used by thousands of people every month to automatically move their balance and direct debits to a new provider; it also forces banks to cover any fees incurred should there be any issues. The only manual change you need to make is moving your salary across, which can be done easily in the portal.

Plum

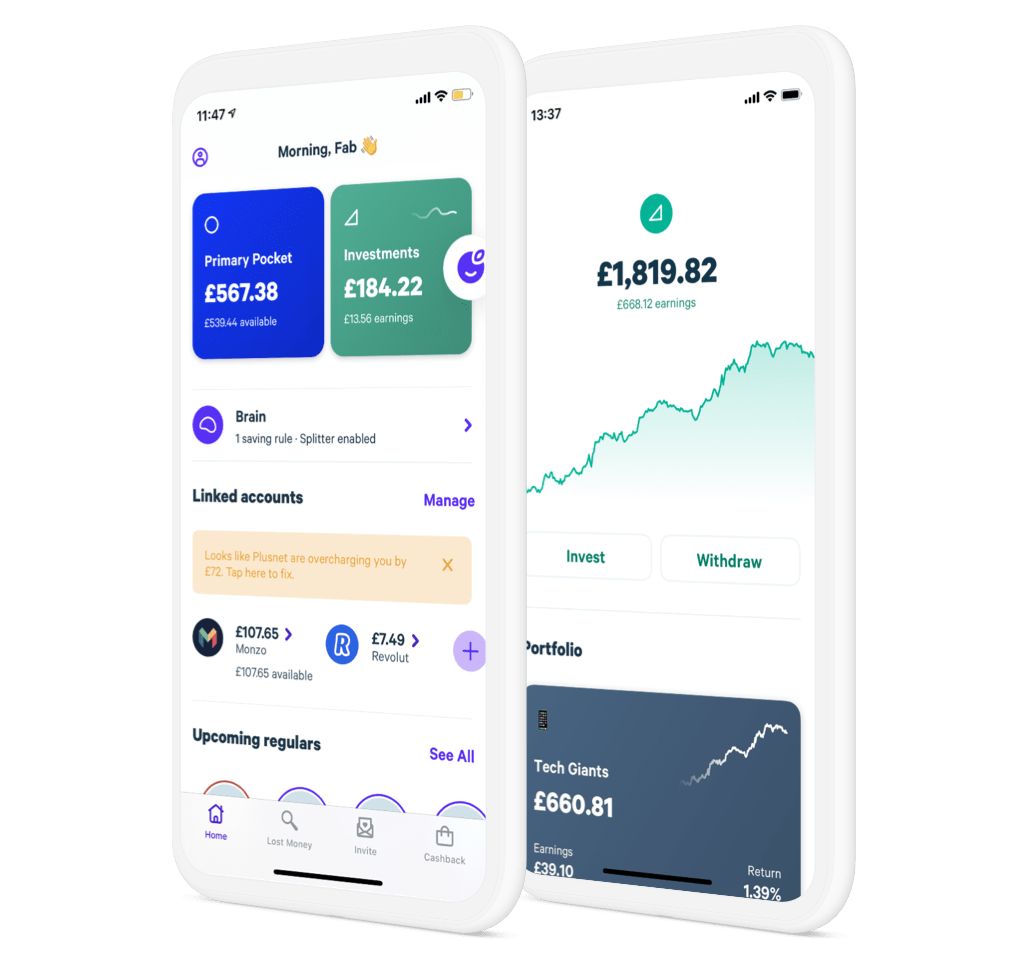

First launched as a Facebook Messenger bot, Plum has since graduated to a full mobile app offering.

After linking your bank account, Plum analyses your regular spending patterns and ‘sweeps’ funds every few days into a simple savings pocket, an interest bearing savings account (currently 0.25%), or a stocks & shares ISA. If you wish, you can have it split the ‘sweeps’ across all the accounts you hold with them.

‘Sweeps’ are determine based on Plum’s determination of your excess disposable income and a sliding scale for how proactive you want it to be (with the top end saving 75% more than the default); alternatively you can lower this or pause during periods like Christmas. Even with Plum’s free tier, you’ll quickly find you’ve saved more than you’d expect without noticing. I really boosted my savings during lockdown by adjusting my setting to ‘🦁 Beast mode’. Likewise, the automatic payday savings reinforces Principles 1, 2, and 3 from above.

Joining Plum Plus for £1 per month gives you access to the stocks & shares ISA and their chosen funds. Several fund managers are available and new options are often added throughout the year.

Additionally, Plum will give you helpful spending nudges and offer to switch your utilities if it looks like you’re paying more than you should be. The £2.99 per month tier also provides retailer cashback and discounts for several brands.

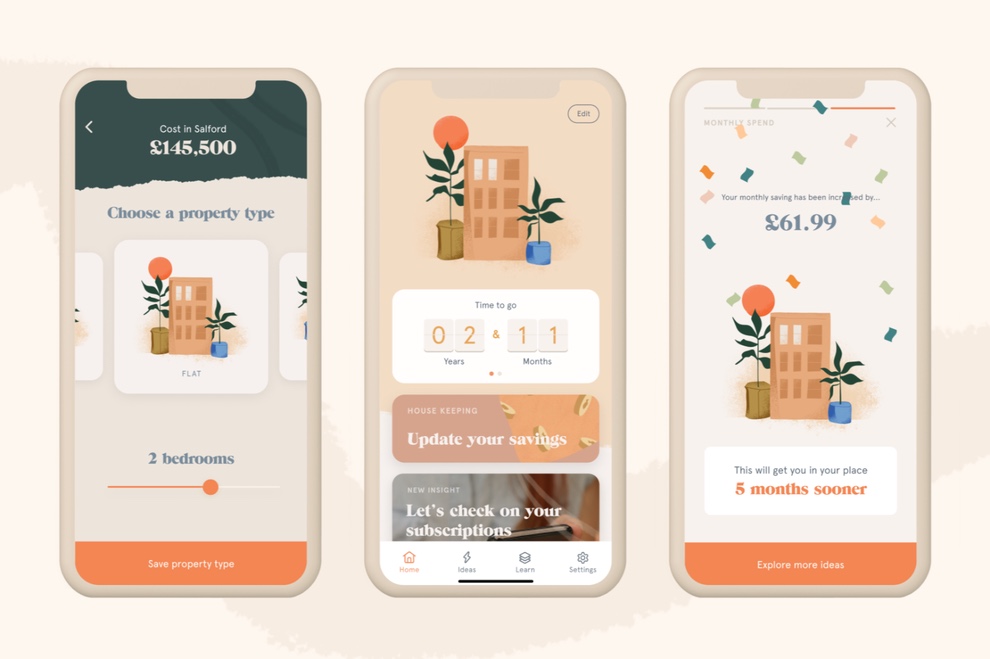

Nude

I became a home-owner a few years ago but if I were starting out now, I’d definitely be using Nude. The app takes a practical approach to getting on the housing ladder by:

- sourcing estimated deposit sized based on postcode and property data

- predicted a likely readiness to purchase date

- making it easy to take advantage of the government’s 25% ISA bonus, and

- nudging you towards better spending habits with regular challenges.

It’s a super simple service designed around one specific customer use case.

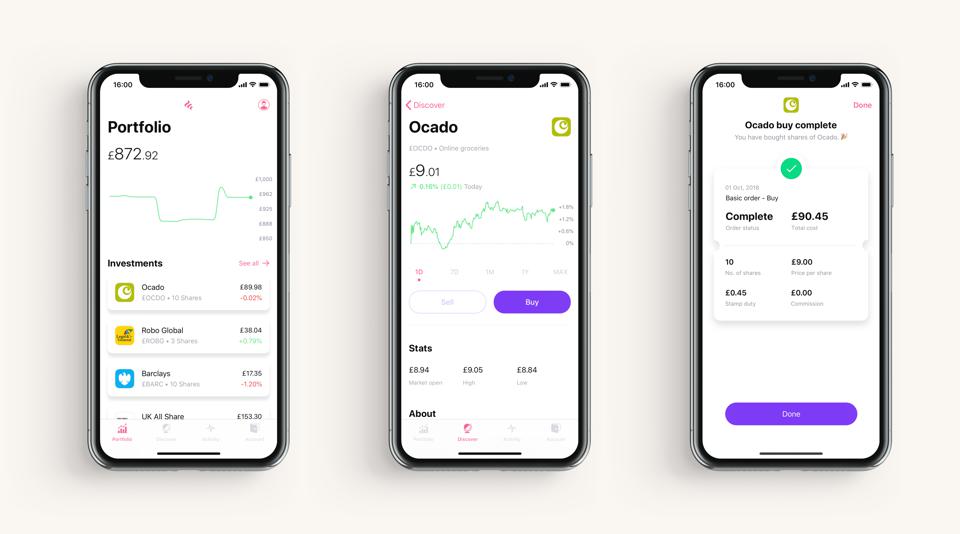

Freetrade

Finally, the fun part. You’ll likely have seen an explosion in stock market discussion throughout lockdown as stay-at-home stocks soared and cruise lines faltered.

The easiest and cheapest way to experiment is using Freetrade. As the name suggests, you can buy and sell most large cap UK and US stocks with no transaction fees. Freetrade also offers several funds and bonds should you wish to limit your risk. You can trade as little as £2 per transaction and top-up instantly using Apple or Google Pay. You should not invest more than you can afford to lose; however even a small investment in your favourite companies is a great way to learn the basics of the stock market.

If you sign-up using a friends link you’ll both receive a free share to get you started - who knows, it might be the next GameStop.

More sophisticated investors can choose to open a stocks & shares ISA or even a self-invested personal pension with Freetrade (both come with a monthly fee). The free tier is definitely enough for you to get started.