Goldman Sachs may be the most influential retail banking provider in the next generation of financial services. And not a single end customer will know about it.

From partnerships with Apple and Amazon to direct to consumer offerings like MarcusPay, Goldman’s retail banking expansion has been methodical and wide-ranging. Individually any of the offerings or partnerships would be impressive; collectively they create a sustainable banking portfolio that will likely have higher average margins, better risk diversification, and lower cost distribution.

The three reasons for this are:

- The propositions are typically focused on instant credit access or fixed term savings, giving them higher yield on lending and more predictable rates on savings.

- Customers of the partners skew towards higher income demographics or have a more data rich customer profile that results in more accurate credit risk assessments.

- Their partners provide most, if not all, of the marketing and distribution effort - often to a massive and engaged customer base.

Let’s break down a selection of the individual partnerships and propositions.

MarcusPay x JetBlue - US Proposition

Initially piloted with JetBlue Vacations, MarcusPay provides customers with flexible point of sale (PoS) financing for large one-off purchases. The proposition is simple: a single monthly payment with no fees (beyond the principal and payment) spread over 12 or 18 months. Certainly not a groundbreaking proposition but sometimes simple beats innovative.

MarcusPay gives Goldman the ability to build their underlying PoS technology in preparation for a future API-enabled offering. This would allow any retailer to add a simple code snippet to their website, like Stripe’s developer-friendly product, and instantly increase the financing options available to all customers.

The proposition provides an exclusive distribution channel for their lending products and, if they continue to partner with recognisable companies like JetBlue, lower credit risk due to the likelihood of that customers are prime or even super-prime. The nature of the PoS products provides Goldman with a consistent repayment schedule and predictable interest margin.

Saga Savings - UK Partnership

Customers of Saga, the over-50s travel and insurance specialist serving nearly 3 million people in the UK, are able to access competitive rates on fixed and easy access savers and apply online in minutes.

Like the JetBlue partnership, Saga customers are inherently low risk due to their near or in-retirement status and inherent propensity for a higher amount of recreational travel; these two factors likely correlated with a higher than average disposable income or savings safety net.

The savings accounts are featured prominently in Saga marketing materials and receive homepage call to actions. Goldman is able to offer the competitive rates by outsourcing the marketing and distribution of the products to Saga and the simple product minimises customer servicing overheads; this all leads to a more sustainable interest margin.

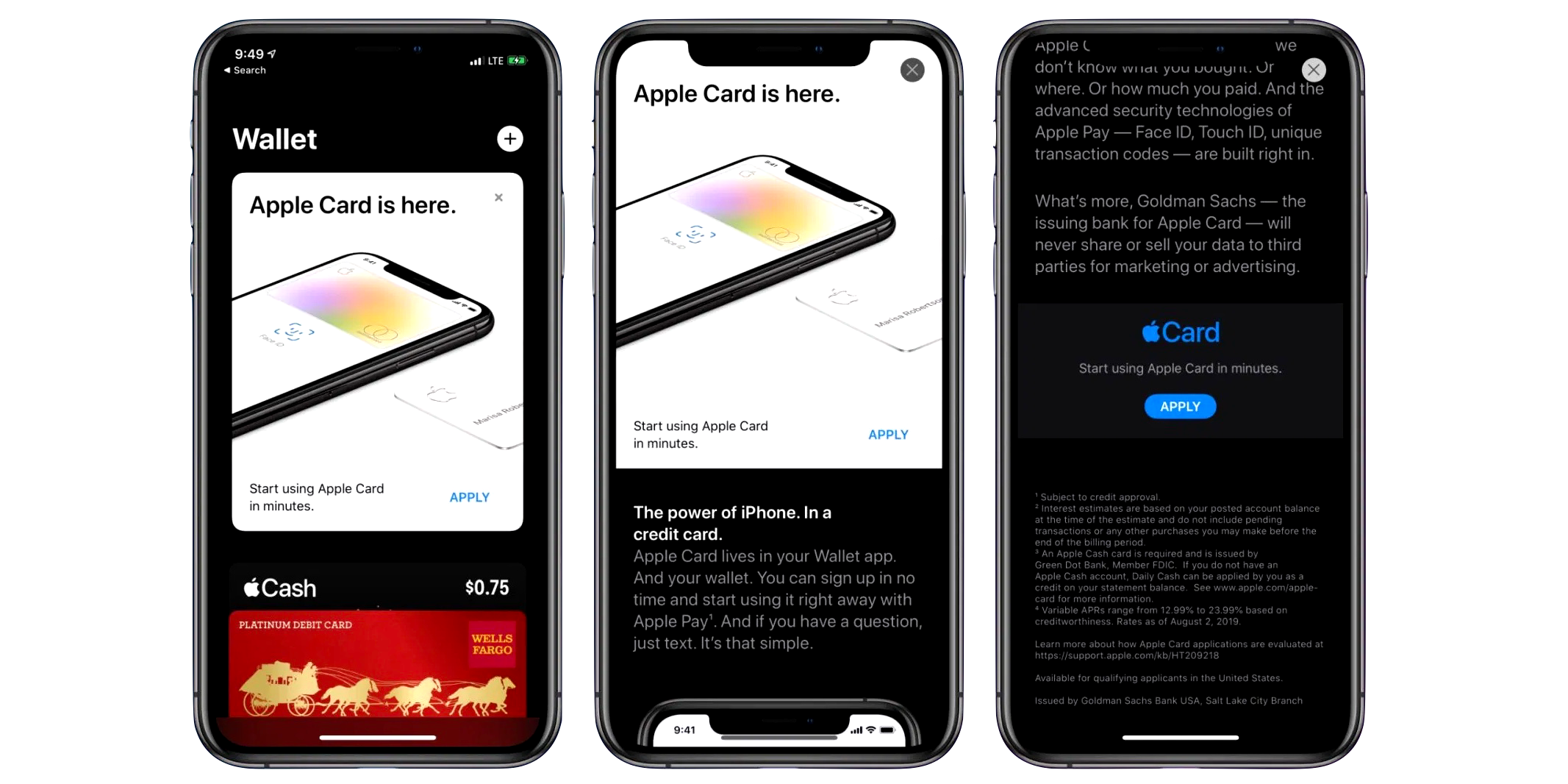

Apple Card - US Partnership

US-only for now, the Apple Card launched with significant fanfare. The proposition rethinks a number of underlying aspects of the credit card experience, nudging customers to re-pay weekly rather than monthly and helping users understand the impact of their payments on the overall balance and interest.

Rumour has it the product development wasn’t easy on Goldman. But from that they’ve built a sustainable advantage that no other competitor can possibly match: direct marketing and distribution to over 100 million US iPhone users and (I’d expect) first shot at any international expansions.

Again, Goldman has smartly outsourced most (if not all) of the product marketing and distribution to an extremely strong consumer brand. And, another recurring theme throughout their partnerships, the typical customer they can expect from the offering has a bias towards higher income levels.

Amazon SME Lending - US Partnership

Small and medium sized businesses in the US can apply for working capital loans from Amazon to support their immediate business growth - the application and servicing of the loans is all done digitally through the Amazon Seller Central and enabled by Goldman Sach’s credit lines.

By integrating financing into the Amazon seller platform, Goldman are able to more accurately understand a business’s performance and growth potential. The richness of this data provides a clear competitive advantage for Goldman while Amazon leverages Goldman’s regulatory status to simplify their operations.

This offering is by no means unique; both Shopify and Stripe have capital offerings and leverage the unique data they have on their SMEs. But Amazon gives Goldman instant scale and distribution with a best-in-class digital experience and growing seller ecosystem.

Only The Beginning

Goldman’s direct consumer banking offering may be limited for now, especially in the UK, but their partnerships are much more comprehensive. Their acquisition of Clarity Money and the capabilities they are developing in-house will give them a powerful foundation on which they can build an all-in-one spending and wealth platform.

But even if the direct consumer proposition lags, they’ll still have an extremely pervasive banking-as-a-service proposition that will grow in lockstep with some of the largest consumer-facing brands globally. The scale and potential of their strategic partnerships may be so big, Goldman can’t fail.